5 keys to safe trading in the currency market

Contents

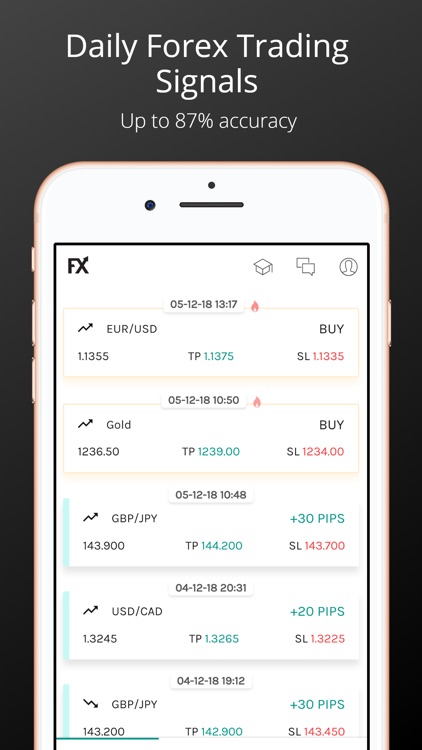

Instead, they are traded between two parties over the internet or through a broker. The market is open 24 hours a day, seven days a week, which allows traders to trade whenever they want. Spread one is the difference between the buy and sell prices for forex trading pairs.

When trading a volatile currency rate pair, a smaller position size may be required. Volatility is a term used to describe price fluctuations relative to an average price over a period of time. Currency volatility, also known as Forex volatility, is the almost constant change in exchange rates in the global foreign exchange market. Even though direct trading in the foreign exchange market cannot happen, currency trading is permitted through the stock exchange. For example, the base currency has to be the Indian Rupee and the pairs that are allowed are the US dollar, Japanese Yen, British pound, and Euro. The International currency market involves participants from around the world.

Like other financial assets, you can incur losses or make profits while trading crypto. If you learn a profitable strategy and manage your risk, then you will have the odds in your favour. Now that you know the key differences between forex and crypto trading, you may be wondering which one is right for you.

Who Controls the Forex Market?

If there’s a rise in a certain currency against the domestic one, then one earns an amount that was previously decided upon. If there’s a drop in the currency, one loses the amount that had been bet. The relative weakness/strength of the market movement is visible in advance of the reversal momentum. Negative extremes mean oversold, positive ones about overbought, respectively. When the expiration dates of serious options are approaching.

But fixed time trading is also risky like other equity investments. The special thing about this type of investment is that you can start it even with a small investment and the possible loss from it is already determined. Know your currency pairs and the factors that can affect their value. One change in policy can lead to overnight price fluctuations. The rapid ups-and-downs imply higher chances of both profits and losses as well. Hedge funds and portfolio managers take up the second spot as the prime players in the forex market.

Exotic Currency Pairs

Basically, there are two types of moving average; Simple moving average, and Exponential moving average. Some traders find Simple moving average effective while for other traders Simple moving average can be a very helpful tool. Moving Average while using scalping strategy in currency trading. Suppose, you open positions and achieve 10 to 15 pip gains but you cannot close your positions because of Dealing desk forex brokers as they reject to execute your orders. This can be harmful to your trade as you can lose a significant amount of money. Currency trading and you buy any currency you take the entry and when you sell it you exit your position or trade.

- Crypto trading takes place on a decentralized market that is powered by blockchain technology.

- Lower volatile currency pairs are not that useful as you have to wait for prices to change.

- Its line always foresees a probable jump, so the rise or fall of the line shows the direction of the predicted jump and levels out again if the current trend continues.

- For example, a security with sequential closing prices of 5, 20, 13, 7, and 17, is much more volatile than a similar security with sequential closing prices of 7, 9, 6, 8, and 10.

Regional –Pairs that are categorized by areas, such as Scandinavia or Australasia. EUR/NOK (Euro vs. Norwegian krona), AUD/NZD (Australian dollar vs. New Zealand dollar), AUD/SGD (Australian dollar vs. Singapore dollar). Although very well-known, the Euro comes off a little slower and weaker than the fellow popular forex currencies. It might sound ridiculous to some, but if you desire to make money at even three at night, you can do so. Pay 20% upfront margin of the transaction value to trade in cash market segment. The volatility of two currencies may be affected by their correlation.

Call and put options

The key to success with this strategy is trading off a chart time-frame that best meets an individual part-time trader’s schedule. The task of a market participant who wants to make money on strong rapid changes in time is to identify them, to make the right decision to open a position instantly. Such trading is relevant both in forex and binary options. Momentum in forex trading is a sharp upward or downward movement in the value of a currency.

On the other hand, most brokerage platforms allow crypto trading every day of the week. Crypto trading takes place on a decentralized market that is powered by blockchain technology. Blockchain is a distributed ledger system that allows secure and transparent peer-to-peer transactions. With blockchain, there is no central authority that controls or regulates the system.

Currency fluctuations occur when there are rapid changes in the exchange rate of a currency pair over a short period of time. Thus, if a currency began to rise and fall in value compared to another, this would be classified as currency pair volatility. Before continue this article you can also read what is Forex trading and how does it work.

Sharp and strong price movements are considered a special case of flat violations since such a situation is less common during a trend. New-age Business Banking in the same way has helped shape the financial operations of businesses today significantly. So in the case of EUR/USD, EUR is the base currency and USD is the quote currency. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties.

However, there is an increase in the risk percentage as well. There are certain foreign exchange trading platforms on which foreign exchange trading takes place. Forex trading, also known as foreign exchange or currency trading, is the act of buying and selling currencies. The goal of forex trading is to make a profit by exchanging one currency for another via spot trading, futures trading, or forward contracts.

The lower the volatility, the more favorably two currencies are connected with one another. Continuing our USD/CHF comparison, both the Swiss Franc and US Dollar are considered safe-haven currencies. Inflation can also be caused by changes in the housing market, changes in government policy and taxation, and a number of other factors.

Being aware of a security’s volatility is important for every trader, as different levels of volatility are better suited to certain strategies and psychologies. For example, a Forex trader looking to steadily grow his capital without taking on a lot of risk would be advised to choose a currency pair with lower volatility. On the other hand, a risk-seeking trader would https://1investing.in/ look for a currency pair with higher volatility in order to cash in on the bigger price differentials that volatile pair offers. When forex online trading, forex traders should consider current volatility levels as well as prospective changes in volatility. Market players should also think about how volatile a currency pair is when altering their position sizes.

Crypto vs. Forex Trading: What You Need to Know

On average, various currency pairings have varied amounts of volatility. Some traders prefer trading volatile currency pairings because of the larger potential gains. When trading extremely volatile currency pairings, traders should consider limiting their position sizes since the increased potential gain comes with a higher risk. Excessively volatile exchange rates that are not in line with economic fundamentals can lead to real costs to the economy, in turn affecting international trade and investment.

Cross currency pair trading allows you to diversify your portfolio. It allows traders to profit from both differences in interest rates at different economies as well as from exchange rate disparities. But it takes some practice to trade with confidence since it also involves high volatility. It is active day and night, across different time zones, for five days a week. However, there are thick and thin markets that denote when the market is more active and when it is tepid.

If you wish to create a crypto coin, you need to hire blockchain developers, and with the right amount of capital and motivation, you will be done in no time. Crypto trading involves buying and selling cryptocurrencies based on speculations about their prices. Cryptocurrencies are digital or virtual cdo swaps tokens that use cryptography to secure their transactions and control the creation of new units. Bitcoin, Ethereum, Litecoin, and Bitcoin Cash are all examples of popular cryptocurrencies. The rapid fluctuations in price levels might force you to change the direction of your trading plans.

CFD they are a profitable product, enabling you to open a position for a fraction of the full cost of the trade. Unlike leveraged products, in CFDs you do not take ownership of the asset, but take a position on whether you think the market will rise or fall in value. While leveraged products can magnify your profits, they can also magnify losses if the market moves against you. When you do currency market trading, limit the risks by never doing trading based on borrowed funds and never stretch yourself. Nevertheless, there are certain things you can only learn and experience when you enter the currency market. The more time you spend in the market, the better you will understand it.

Spreads are not the only significant factor to consider for those looking for how to do scalping in forex. There is also another quite effective factor that is volatility. Crosses include EUR, GBP, and JPY as the base or quote but do not include USD.